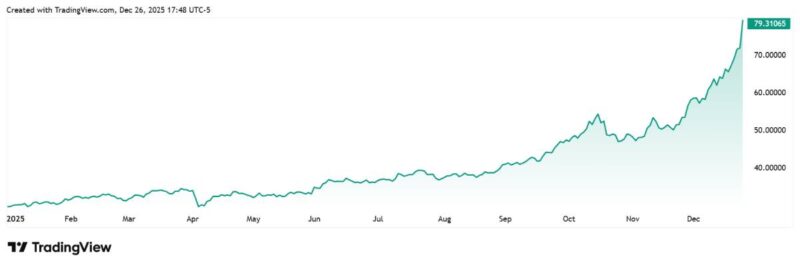

Silver prices increased significantly in 2025, rising from around $29.50 per ounce in January to over $79 by the end of December. The 170% gain reflected higher investment activity, industrial use, and limited supply.

The recent price movement has prompted varied forecasts for 2026. Jewellers may need to consider the potential impact on material costs, sourcing, and pricing.

Price Performance Through 2025

Silver began the year just under $30 per ounce and followed a steady upward trend for most of the year, despite short-term volatility following US trade policy announcements in April. Prices accelerated in the second half of the year, passing key thresholds, including $34 in June and $47 in October, and reaching new highs above $70 by mid-December.

The price rise has been linked to stronger investment demand, ongoing industrial usage—particularly in solar—and reduced inventories in key markets.

Investor Expectations for 2026

According to Kitco News’ Annual Silver Survey, 57% of retail investors expect silver to trade above $100 per ounce in 2026. A further 27% see a range between $80 and $100, while 5% expect a return to the $40 to $60 range recorded earlier in the year.

Analyst Forecasts and Market Risks

Analysts remain divided on silver’s outlook. Heraeus expects a correction in the early part of 2026. “While prices could push higher in the near-term, once the momentum wanes, a period of consolidation is likely,” the firm stated in its 2026 Precious Metals Outlook.

TD Securities forecasts that prices may moderate to the mid-$40s due to a sharp increase in available inventories. “With more than 212 million ounces now likely freely available in the LBMA’s vaults, London silver markets have already unwound a year’s worth of drain,” the analysts wrote.

BMO Capital Markets projects an average silver price of $56.30 per ounce in 2026, with a peak of $60 in the fourth quarter. While the bank expects gold to maintain strength, it expressed caution regarding silver and platinum, citing signs of overbought conditions.

Supply, Industrial Demand, and Inventory Trends

Maria Smirnova, Managing Partner at Sprott Inc., noted that the solar sector, which accounts for approximately 20% of global silver supply, remains a key industrial demand segment. With inventories reportedly moving from London to Shanghai, regional supply dynamics may affect short-term availability.

Smirnova reported that over 100 million ounces were added to Western ETFs in 2025, indicating sustained investor interest despite higher prices.

She said future price movements will depend in part on whether China can secure sufficient imports to meet industrial needs. “Is it still London, or is it going to start moving from the COMEX now? And how much is available?” she asked.

Technical and Market Cycle Outlooks

Some analysts are warning of a potential end to the current cycle. Avi Gilburt of ElliottWaveTrader said: “2026 probably will provide us with the end of this long-term cycle in gold and silver, and potentially kick off another multi-year bear market.” He added that while silver has reached his target range of $75 to $80, short-term upside is still possible if support holds.

Kitco’s Jim Wyckoff expects the silver market to remain strong in 2026 but suggests that the rate of gains seen in 2025 is unlikely to be repeated. “Silver is in a very mature bull market run… there’s no doubt silver is in a boom cycle at present. This indicates that a bust cycle is next. The only uncertainty is the timing,” he said.

Implications for Jewellers

For jewellers, higher silver prices may affect profit margins and require changes to pricing or stock management. Jewellers that use significant amounts of silver may wish to review their sourcing arrangements and monitor market developments closely.

With industrial and investment demand expected to remain strong, the silver market may remain volatile into 2026. Planning for price fluctuations will be important for manufacturers and retailers working with silver in both finished goods and supply chains.